Africa Intelligence Report 2025-2026

Compiled as of January 2, 2026. This report aggregates key events, policies, and analyses on Africa, with a nationalist outlook emphasizing sovereignty, fair trade, and reduced external interference. Review all sections below before publishing.

Africa in 2025: Turmoil, Transition, and Transformation

As we enter 2026, reflecting on the events that shaped Africa in 2025 reveals a continent in flux. From political upheavals and disputed elections to economic challenges and humanitarian crises, the year was marked by stark contrasts—moments of democratic progress juxtaposed against authoritarian crackdowns, economic resilience amid global pressures, and innovative summits addressing long-term development. This comprehensive overview draws from recent reports and analyses to provide a factual, up-to-date account of key events across the continent. While Africa’s diversity defies simple narratives, recurring themes include youth-led protests, resource-driven conflicts, and efforts toward sustainable growth. Below, we break down the major developments by category, highlighting specific countries and broader implications.

Africa’s Political Boundaries – 2025

Political Landscape: Elections, Coups, and Protests

2025 was a pivotal year for African politics, with numerous elections, military interventions, and civic unrest underscoring the fragility of democracy on the continent. According to analyses from sources like the BBC and African Business, the year saw a “difficult” period for democratic processes, characterized by violent elections, coups, and protests that tested governance structures.

Key Elections and Their Outcomes

- Tanzania: The October 2025 general elections were marred by post-election violence, including protests and a nationwide curfew. Opposition parties alleged electoral manipulation, leading to deadly clashes. The ruling party retained power, but the unrest cast a shadow over economic stability, with investors expressing concerns about political risk. This event exemplified how electoral disputes can ripple into broader economic uncertainty.

- Côte d’Ivoire (Ivory Coast): Protests erupted over alleged electoral fraud in the presidential elections, resulting in clashes that highlighted ongoing tensions between the government and opposition. The ruling party secured victory, but international observers noted irregularities, fueling debates on democratic backsliding.

- Guinea: Under junta rule since a 2021 coup, Guinea held delayed elections in late 2025. President-elect Mamady Doumbouya won amid promises of anti-corruption reforms, but concerns persisted over restricted opposition campaigns and dissolved parties. This transition from military to civilian rule was watched closely as a potential model for other junta-led states.

- South Africa: The Government of National Unity (GNU), formed after the 2024 elections, continued to stabilize in 2025, boosting investor confidence and resolving long-standing issues like energy shortages. This collaborative model— involving multiple parties—offered a positive contrast to more adversarial systems elsewhere.

- Other Notable Polls: Elections in Senegal and Kenya saw youth-driven demands for accountability, while South Sudan’s fragile political scene teetered on the edge of a coup or civil war. In Cameroon, a disputed election led to deadly clashes and a major uprising, with opposition leaders facing threats.

Coups and Military Interventions

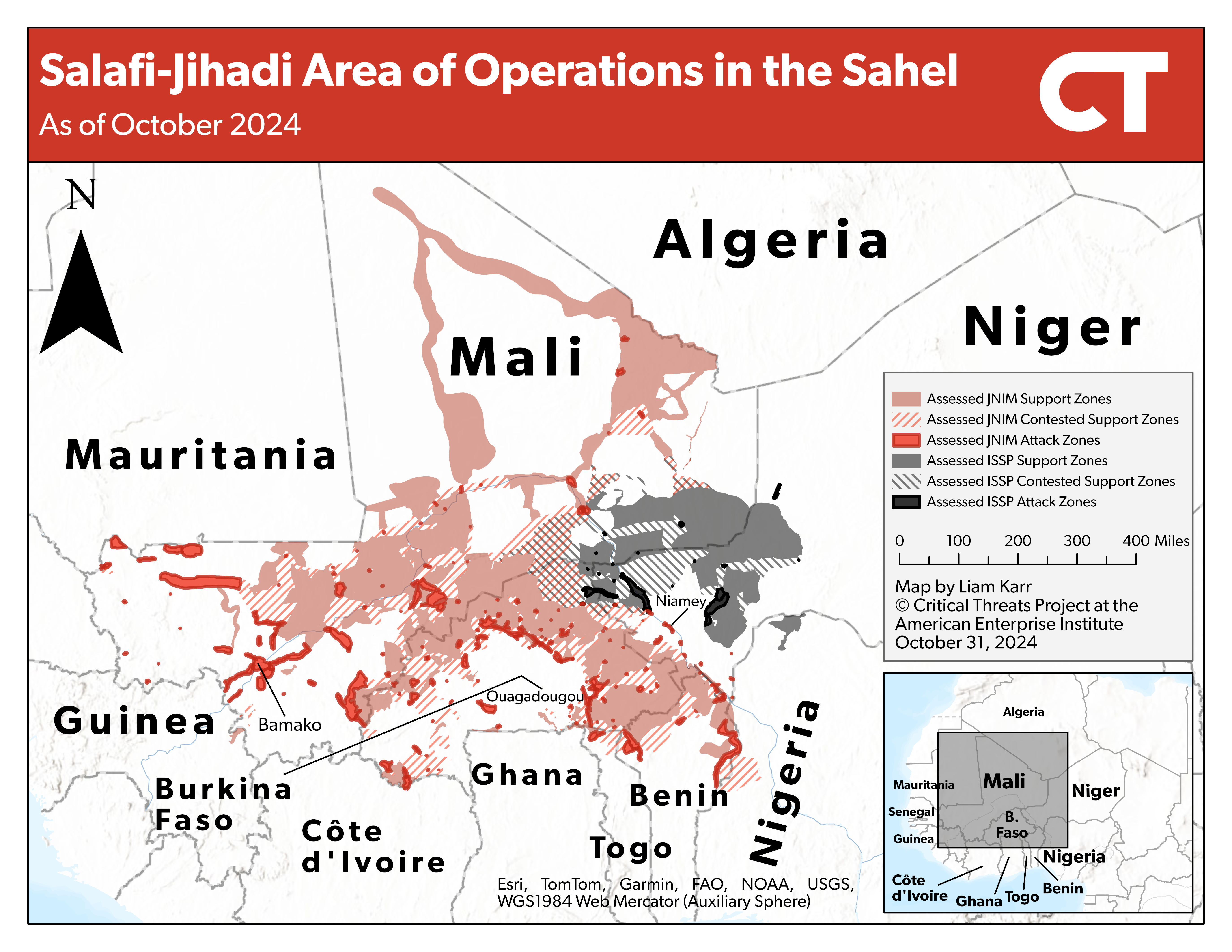

The year featured both successful and foiled coups, particularly in West Africa. Burkina Faso, Mali, and Niger—under military rule—saw relative public trust due to transparency promises, though calls for democratic restoration grew. Jihadist expansions in the Sahel region complicated these transitions, with groups like JNIM gaining ground.

In Ethiopia, internal tensions brought the country to the brink of another civil war, exacerbated by regional disputes.

Youth-Led Protests and Civic Activism

A surge in youth protests highlighted demands for better governance. In Kenya, Gen Z-led movements against economic policies (e.g., finance bills) evolved into broader calls for systemic change, with stages of awareness, anger, and mobilization leading to confrontations with the state.

Similar dynamics played out in Uganda, where opposition figures faced attacks, and in broader contexts like digital rights and anti-corruption drives.

Africa’s push for global influence was evident in forums like the UN Security Council and Non-Aligned Movement, alongside advancements in visa openness.

Conflicts and Humanitarian Crises

Ongoing wars and insurgencies dominated headlines, contributing to potential refugee crises.

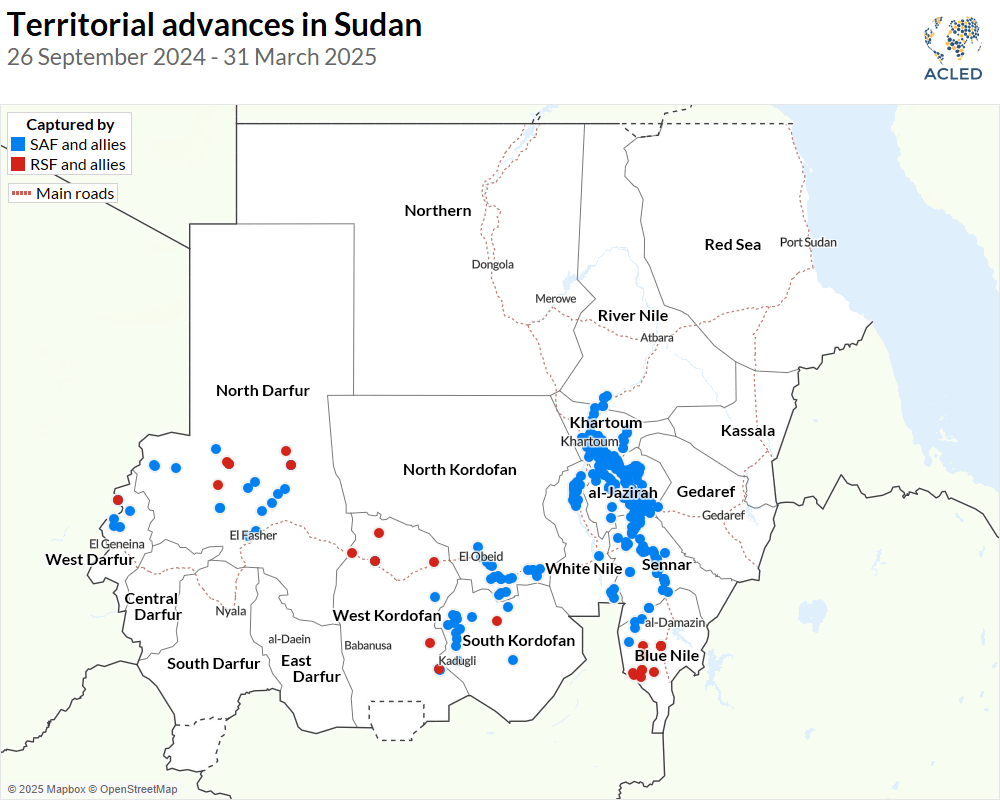

- Sudan: Mass killings and atrocities continued amid civil war, drawing international condemnation.

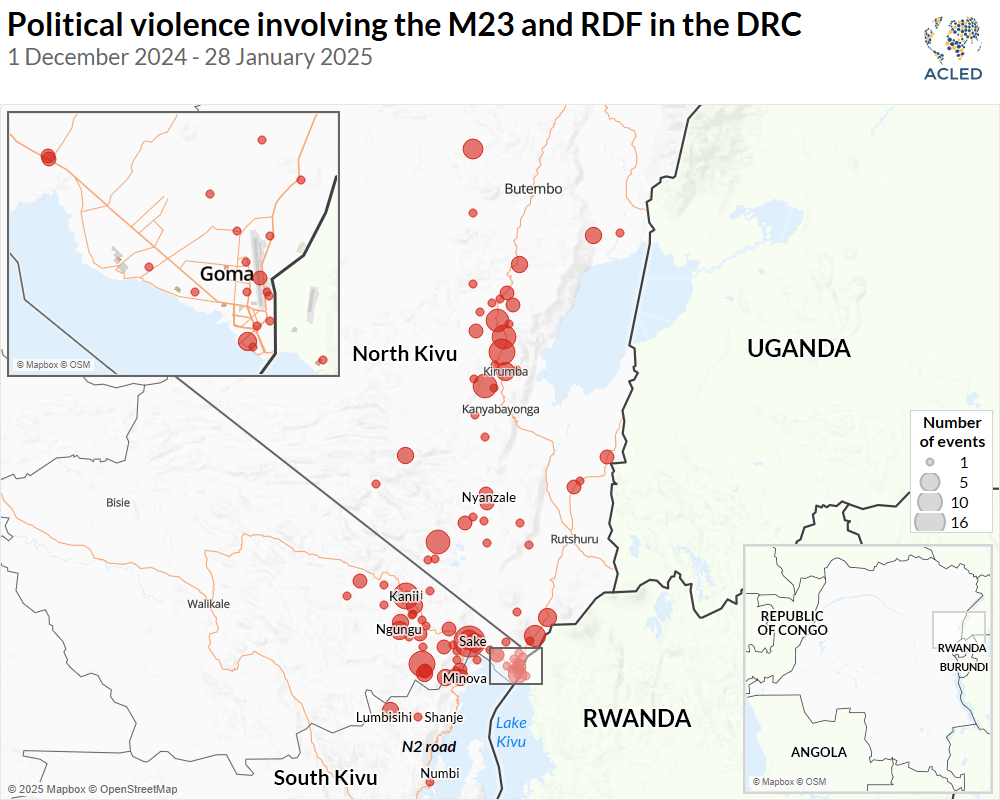

- Democratic Republic of Congo (DRC): Rwanda’s alleged invasion escalated violence, displacing millions.

- Somalia: Mogadishu faced encirclement by insurgents, while a “fresh start” initiative aimed at rebuilding.

- Sahel Region: Jihadist takeovers in Mali and Burkina Faso led to border restrictions and humanitarian shortfalls.

- Migration Tragedies: A migrant boat capsized off The Gambia, killing at least seven, underscoring perilous journeys driven by conflict and poverty.

Aid cuts, including for AIDS relief, worsened crises, with neo-colonial resource extraction adding to instability.

Economic Developments: Growth Amid Challenges

Despite risks, Africa’s economy showed resilience. The IMF forecasted expansion in 2026, with more high-growth economies (6%+) than any other region.

- Job Creation and Unemployment: The World Bank highlighted a mismatch where 11 million youth enter the job market annually, but only 3 million formal jobs are created. Austerity measures in countries like South Africa exacerbated this.

- Neoliberal Policies and Inequality: Critiques pointed to IMF/World Bank-driven privatization and resource extraction, perpetuating dependency. In Nigeria and beyond, transfer pricing by multinationals drained wealth.

- Financial Watchlists: Eight countries, including Algeria, remained under FATF monitoring, facing economic hurdles.

- Energy and Infrastructure: Electricity costs rose in South Africa, while conflicts disrupted fishing and trade in Gambia and Somalia.

Positive steps included reversals of neocolonial controls in West Africa, asserting ownership over resources.

Social and Development Initiatives

- Summits and Forums: The 38th African Union Summit (Jan-Feb 2025) focused on unity. The Africa Food Systems Forum in Dakar (Aug-Sep) addressed agriculture. UNESCO’s Africa Week emphasized heritage restitution. The Africa Regional Forum on Sustainable Development in Uganda tackled SDGs.

- Health and Education: Funding shortfalls for research and public services persisted, with underpaid workers in Ghana and elsewhere.

- Cultural and Miscellaneous: Celestial events like meteor showers captivated skies, while incidents like Anthony Joshua’s driver crash in Nigeria made headlines.

Outlook for 2026

Entering 2026, Africa faces elections in Uganda, Ethiopia, and Zambia, alongside forums on trade and energy. Economic expansion is projected, but risks from conflicts and debt loom. Youth activism and anti-neoliberal shifts could drive progress, but ignoring these dynamics risks larger crises, including migration waves to Europe.

Africa in 2025: Escalating Conflicts, Contested Elections, and Resilient Growth Amid Global Shifts

As 2025 concludes on January 2, 2026, the year proved turbulent for Africa, marked by intensified armed conflicts, disputed elections often marred by violence and crackdowns, multiple coups, and humanitarian crises on an unprecedented scale. Despite these challenges, economic forecasts showed resilience, with projected growth holding steady amid global uncertainties. Sporting triumphs, particularly the Africa Cup of Nations (AFCON) in Morocco, provided moments of unity. This updated overview for IntelligenceReport.info incorporates late-2025 developments, including ongoing AFCON matches, December elections, and security escalations.

Political Turmoil: Disputed Elections, Protests, and Coups

2025 saw over 10 presidential elections, many reinforcing entrenched power rather than fostering renewal, alongside a surge in coups and youth-led protests.

Major Elections and Unrest

- Cameroon: President Paul Biya, aged 92, won an eighth term, triggering major protests and crackdowns.

- Tanzania: Post-election violence followed disputed results, with police shootings of demonstrators shattering the country’s stable reputation; regional bodies condemned the process.

- Côte d’Ivoire: President Alassane Ouattara secured re-election amid disqualifications of key opponents (e.g., Laurent Gbagbo, Tidjane Thiam), leading to protests in Abidjan.

- Guinea: Junta leader Mamady Doumbouya won a controversial presidential vote on December 28, legitimizing military rule four years after his 2021 coup.

- Central African Republic: President Faustin-Archange Touadéra sought a third term in the December 28 election, amid criticism and reliance on Russian mercenaries.

- Other contested polls in Gabon, Togo, and beyond highlighted a trend of incumbents extending mandates through manipulation or force.

Coups and Military Interventions

Successful coups in Madagascar (deposing President Rajoelina after protests) and Guinea-Bissau (late 2025).

Foiled attempt in Benin.

Military rule solidified in Sahel states (Mali, Burkina Faso, Niger), bringing the total junta-led countries to eight.

Youth and Gen Z protests drove change in several nations, reflecting demands for accountability amid economic hardship.

Security and Humanitarian Crises: Wars Intensify

Conflicts dominated, creating the world’s largest crises.

- Sudan: Civil war between SAF and RSF fragmented the country; RSF captured El Fasher (October), exacerbating famine (600,000+ exposed) and displacement (12.8+ million). Spillover affected neighbors like Chad and CAR.

- Democratic Republic of Congo (DRC): Rwanda-backed M23 rebels captured Goma (January) and advanced, taking key mineral sites like Rubaya coltan mine; violence displaced millions.

- Sahel: JNIM (al-Qaeda affiliate) escalated attacks on cities, imposing blockades (e.g., Bamako fuel crisis); jihadist expansion threatened coastal states.

- Somalia: Al-Shabaab offensives neared Mogadishu; prison attacks and gains despite AU mission progress.

Broad trends: Drone proliferation, urban violence surges, and climate shocks worsened displacement and food insecurity.

Humanitarian needs soared, with funding shortfalls amid aid cuts.

Economic Resilience Amid Headwinds

IMF/World Bank forecasts: Sub-Saharan Africa growth at ~3.5-4.1% in 2025, accelerating to 4.3% in 2026, driven by private consumption, stabilization in key economies, and high performers (e.g., Senegal at 8.4%).

Challenges: Debt distress, commodity volatility, aid reductions, and trade disruptions.

Positives: Critical minerals demand, digital economy expansion, and infrastructure pushes.

Key Forums and Initiatives

38th AU Summit (February, Addis Ababa): Focused on reparatory justice, education financing, and energy strategies.

Tech events highlighted AI, fintech, and innovation.

South Africa prepared for G20 presidency handover.

Sports and Cultural Highlights

AFCON 2025 (Morocco, December 2025–January 2026): Ongoing tournament featured dramatic matches; Morocco hosted amid high media attention.

Athletics: African dominance at World Championships (e.g., Botswana’s historic relays).

Outlook for 2026

High-stakes elections loom in Uganda (January, Museveni likely extends rule), Ethiopia, Somalia, South Sudan (delayed independence polls), Zambia, and others—risking further unrest. Conflicts in Sudan, DRC, and Sahel may persist or spill over; economic growth projected but fragile. Youth activism, geopolitical rivalries (e.g., Russia, China, US), and climate pressures will shape the year.

NGOs in Africa 2025: Operations, Funding, and Governmental Pushback

As part of the ongoing analysis for IntelligenceReport.info, this section compiles key data on Non-Governmental Organization (NGO) operations across Africa in 2025, drawn from recent reports, summits, and analyses. The continent saw robust NGO activity in areas like poverty reduction, humanitarian aid, education, and sustainable development, but amid shrinking civic space, funding constraints, and increasing governmental restrictions. Pushback often stemmed from perceptions of foreign influence, with laws limiting advocacy and operations. Below is a structured overview, focusing on major players, activities, and challenges up to December 2025.

Major NGO Operations and Activities

NGOs played a critical role in socio-economic development, conflict response, and innovation, with a surge in tech integration (e.g., AI for sustainability) and regional summits fostering collaboration.

- Top NGOs Active in 2025: Based on impact assessments, leading organizations included:

- YUVA Mauritius: Focused on youth empowerment and community development in East Africa.

- ForAfrika: Emphasized food security and agricultural resilience across sub-Saharan regions.

- Self Help Africa: Prioritized rural livelihoods, farming innovations, and climate adaptation in countries like Ethiopia and Zambia.

- The Hunger Project: Targeted malnutrition and women’s empowerment in West and East Africa.

- Other notables: African Wildlife Foundation (conservation), Save the Children (child rights in conflict zones), and Oxfam (inequality reduction in Southern Africa).

Key Sectors and Contributions

- Poverty Reduction and Job Creation: West African NGOs drove initiatives in skills training and entrepreneurship, creating jobs amid high youth unemployment. In conflict hotspots like the Sahel and DRC, NGOs provided emergency aid despite attacks and logistical hurdles.

- Humanitarian and Health: Operations in Sudan, Somalia, and Ethiopia focused on famine relief, with 77 projects submitted to foundations like Nexans emphasizing electrification and access in Africa—the most represented region globally.

- Education and Advocacy: Efforts included reparations forums and SDGs alignment, with events like the October 2025 NGOs Forum in Gambia addressing historical injustices.

- Tech and Innovation: Webinars on World NGO Day (February 2025) highlighted AI, tech, and sustainability for operations, hosted by groups like Hexa Media Africa.

Summits and Networking: The Africa Non-Profit Summit 2025 served as a hub for uniting organizations, policymakers, and leaders for capacity building and knowledge exchange. Job markets expanded via platforms listing vacancies in humanitarian roles across the continent.

Funding Landscape: December 2025 saw calls for grants supporting African NGOs, with opportunities from international donors amid efforts to reduce foreign aid dependency. Total projects: Over 116 global submissions, with Africa leading at 77.

Pushback and Restrictions Against NGOs

Governments across Africa intensified scrutiny, viewing some NGOs as threats to sovereignty, leading to regulatory crackdowns, funding blocks, and operational limits. This trend aligned with broader youth protests against governance failures.

- Civic Space Shrinkage: Increasing restrictions on freedom of association and advocacy, with governments imposing bureaucratic hurdles and surveillance. In West Africa, this limited NGO effectiveness in political development.

- Funding and Donor Challenges: Pushback included efforts to curb foreign aid dependency, with NGOs adapting to local funding models amid donor withdrawals and office closures. Global political shifts, like reduced international support, exacerbated this.

- Protest and Advocacy Suppression: In countries like Mozambique, Senegal, Tunisia, and Uganda, authorities cracked down on NGO-linked protests against injustice and corruption. Youth-led movements in 2025 highlighted unemployment and governance issues, often met with force, undermining NGO human rights work.

- Humanitarian and Gender Pushback: Global aid overviews noted reversals in inclusion and gender equality gains due to political resistance, affecting NGOs in conflict zones. Information sourcing changes (e.g., ACLED reports) indicated evolving threats to NGO operations in volatile areas.

- Resilience Amid Pressure: Despite challenges, civil society showed adaptability, with predictions of survival through innovation and local partnerships.

Trump Administration Actions on Africa Policy: Comprehensive Data Pull (as of January 2, 2026)

This report compiles all available data on Trump administration actions regarding Africa policy, covering the first term (2017-2021) and second term (2025 onward). Data is drawn from official sources, think tanks, and media reports. Focus areas include trade, security, aid, diplomacy, and country-specific engagements. Chronological summaries are provided where applicable.

First Term (2017-2021): Focus on Trade, Security, and Partnerships

The first Trump administration prioritized economic ties, countering Chinese influence, and security partnerships, while continuing many bipartisan initiatives. Africa received limited personal attention from Trump, but policies built on predecessors’ efforts in health, trade, and stability.

Economic and Trade Initiatives

Launched Prosper Africa in 2019 as a flagship initiative to boost two-way trade and investment, creating a “one-stop shop” for U.S. businesses and “Deal Teams” at U.S. missions in Africa. It aimed to improve investment climates, support sustainable projects, and was later replicated globally. Goals included mobilizing private capital, with components like advisory services and coordination across 17 U.S. agencies. Funding involved $50 million in reprogrammed USAID funds for FY2020, plus DFC resources; congressional critiques noted limited new funding and slow rollout.

Established the U.S. International Development Finance Corporation (DFC) via the BUILD Act (2018), doubling investment capacity to $60 billion, with sub-Saharan Africa as the largest portfolio share (e.g., equity investments in “bankable projects” for job growth).

Supported the African Growth and Opportunity Act (AGOA), marking its 20th anniversary in 2020, benefiting 39 countries with duty-free access to U.S. markets; emphasized rule of law, anti-corruption, and workers’ rights.

Backed the Africa Continental Free Trade Agreement (AfCFTA) implementation, focusing on non-tariff barrier removal; initiated bilateral FTA negotiations with Kenya.

Introduced 2X Africa Initiative (2019) with $1 billion commitment to empower women economically, launched in Ethiopia.

Country-specific: In Ethiopia, hosted investor forums leading to $300 million Coca-Cola investment; in DRC, supported GE’s multi-billion investments in energy and healthcare.

Security and Peace Efforts

Partnered with African governments on counterterrorism, addressing violent extremist organizations (VEOs) in Sahel (e.g., Burkina Faso, Mali) and Somalia.

In Sudan, facilitated post-Bashir transition (2019) with special envoy, “Friends of Sudan” group, and support for civilian-led government.

In DRC, aided President Tshisekedi’s anti-corruption and human rights reforms; largest donor for Ebola response.

In South Sudan, appointed special envoy to enforce 2018 peace agreement.

Supported stability in Cameroon (ending civil war) and Ethiopia (reforms under PM Abiy, including Eritrea peace).

Congress preserved security assistance funding despite proposed cuts to U.S. military presence.

Aid and Development Programs

Millennium Challenge Corporation (MCC): 70% of portfolio in Africa, with $3 billion active and $1.8 billion pipeline for reform-committed countries.

Young African Leaders Initiative (YALI): In its 10th year (2020), built leadership capacity; alumni impacted governance and de-radicalization.

Women’s Global Development and Prosperity Initiative: Improved women’s land rights in Ethiopia.

Health focus: Continued PEPFAR (AIDS), malaria initiatives; First Lady Melania Trump’s 2018 visits to Ghana, Malawi, Kenya, Egypt emphasized maternal care and education.

University partnerships and diaspora engagement to boost ties.

Diplomacy and Statements

Senior visits to 10+ countries; emphasized “Afro-Optimism,” youth potential, and countering China’s unsustainable investments.

Relations marked by mistrust in some capitals due to neglect, but policies seen as continuing U.S. commitments in health, rights, and peacekeeping.

Second Term (2025-): Security-First, Trade Over Aid, and Targeted Engagements

In 2025, Trump’s second term shifted to “America First” priorities, emphasizing security, mineral access, and trade while cutting aid and democracy promotion. Africa featured minimally in the National Security Strategy, focusing on countering China via economic vitality and critical minerals (Africa holds 30% of global reserves). Key advisor: Massad Boulos (appointed April 1, 2025) as Senior Advisor for Africa.

Key Actions and Executive Orders

- EO 14204 (Feb 7, 2025): Addressed “egregious actions” by South Africa, halting U.S. aid and promoting Afrikaner refugee resettlement amid claims of white farmer persecution.

- EO 14169 (Jan 20, 2025): Reevaluated and realigned U.S. foreign aid, leading to USAID dismantling and cuts (e.g., halting shipments to Sudan, DRC; potential 14M additional deaths globally by 2030).

- EO 14163 (Jan 20, 2025): Realigned refugee admissions, impacting African refugees.

- EO 14161 (Jan 20, 2025): Protected U.S. from foreign terrorists, restoring/expanding travel restrictions (June 2025 update) affecting African nations based on security assessments.

- EO 14150 (Jan 20, 2025): Directed “America First” policy to State Department, influencing Africa engagements.

- EO 14362 (Nov 24, 2025): Designated Muslim Brotherhood chapters as terrorist organizations, affecting security in African countries.

- Other EOs (e.g., tariffs on Brazil, China, Russia) indirectly impacted Africa via global trade/security, but no direct Africa-specific beyond listed.

Security and Conflict Resolution

Resumed airstrikes: Somalia (Feb 1, killing ISIS leader; ongoing vs. Al-Shabaab); Nigeria (Dec 25, targeting ISIS amid Christian protection claims).

Brokered DRC-Rwanda peace: Preliminary deal (June 27), full agreement (Dec 4) for mineral access and stability.

Sudan efforts: Quad negotiations (Oct); mid-Dec mediation with SAF leader; prioritized for 2026 amid ongoing war.

Placed Nigeria on religious freedom watchlist (Oct 31) as “Country of Particular Concern.”

Immigration restrictions: New student visa limits impacted African youth; broader curbs on migration from conflict zones.

Economic and Trade Developments

Launched commercial diplomacy strategy (May), viewing Africa as trade partner; $2.5B deals at U.S.-Africa Business Summit (June, Angola) in infrastructure, energy.

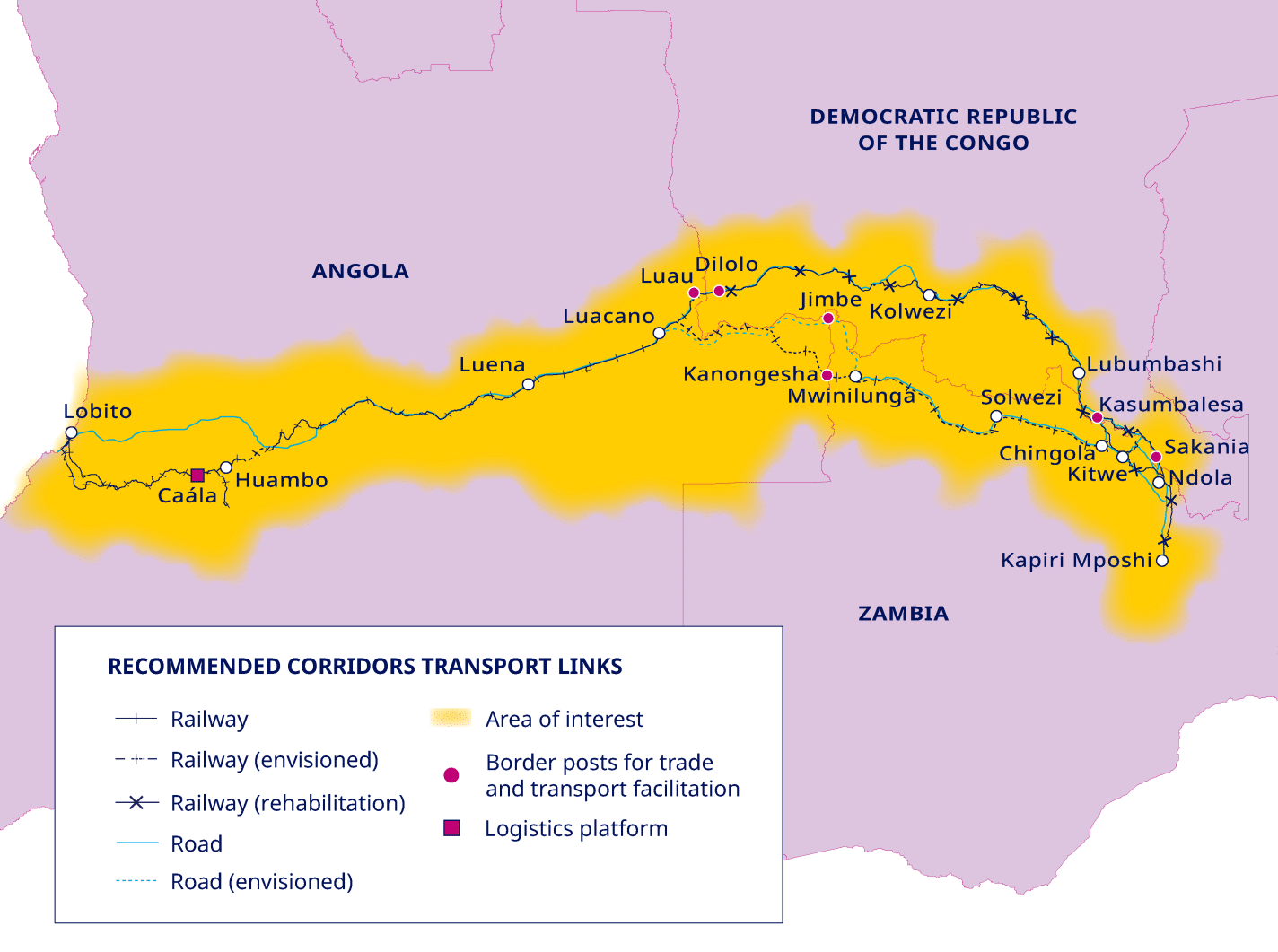

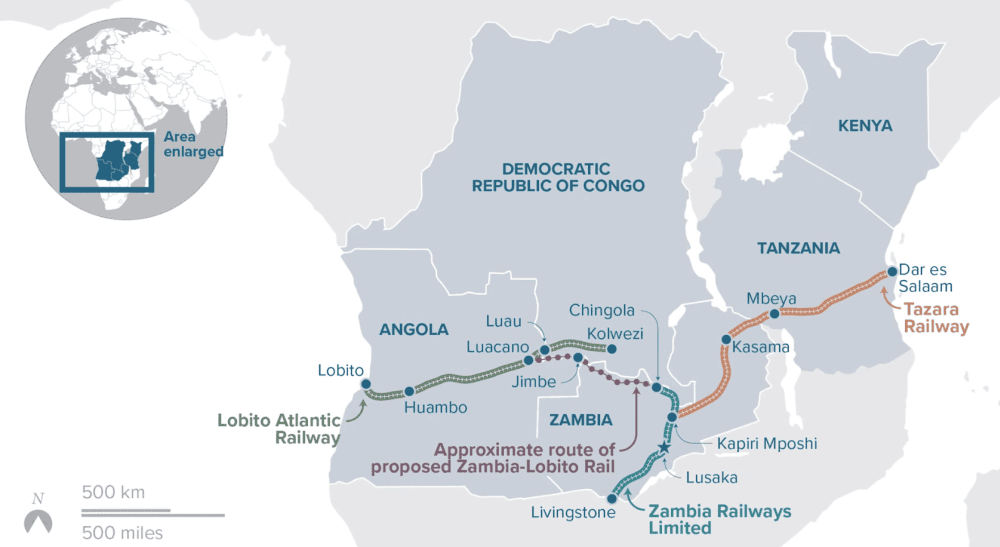

Invested $553M loan in Lobito Corridor (Dec 17) for mineral transport.

Supported AGOA extension but imposed tariffs (15% on 13 countries, 30% on South Africa) post-lapse (Sep).

Countered China: Emphasized U.S. FDI and trade to rival $296B Chinese trade (2024).

Aid and Development Shifts

Dismantled USAID, reducing contributions to African Development Fund/Bank (2026 budget proposal); shifted from aid to trade.

De-emphasized human rights/democracy for conflict resolution and business.

Country-Specific Relations and Diplo

macySouth Africa: Feud over “white genocide” claims; Oval Office clash (May 21); G20 boycott (Nov); disinvited from 2026 U.S. summit.

Hosted West African leaders (July 9: Gabon, Guinea-Bissau, Liberia, Mauritania, Senegal) at White House.

Hosted West African leaders (July 9: Gabon, Guinea-Bissau, Liberia, Mauritania, Senegal) at White House.

Strengthened ties with Morocco (Western Sahara); strained with Nigeria (religious issues), South Africa (ICJ Israel case).

Overall: Security focus in Sahel/Sudan; trade push in Angola, Ghana, Botswana.

Outlook

Second-term policies risk worsening tensions (e.g., aid cuts, tariffs) but offer opportunities in peace deals and investments. Data current as of Jan 2, 2026; no major 2026 actions yet.

Trump’s Africa Policy Through a Nationalist Lens: Tariffs, Sovereignty, and Global Implications

As of January 2, 2026, the second Trump administration’s approach to Africa reflects a broader “America First” framework, emphasizing transactional realism, reduced foreign aid, and targeted interventions. This analysis for IntelligenceReport.info examines the user’s proposed outlook—tariffs benefiting all parties, NGOs and state actors as detrimental, the Monroe Doctrine as a universal first principle, and beneficial nationalism for all nations—in the context of factual developments. While this perspective aligns with elements of Trump’s rhetoric on sovereignty and economic protectionism, real-world applications reveal complexities, including economic disruptions and geopolitical trade-offs. Data is drawn from official strategies, executive actions, and expert analyses.

Tariffs: Protective Measures or Economic Clashes?

The administration has leveraged tariffs to prioritize U.S. interests, imposing a 30% levy on select South African goods and 15% on products from 13 other African nations following the AGOA lapse in September 2025. Proponents argue these foster fair trade and protect domestic industries, potentially encouraging African self-reliance. However, critics note adverse effects: Lesotho, reliant on U.S. denim exports, faced factory closures, while broader African economies grappled with volatility amid global commodity shifts. Africa’s response includes diversification toward intra-continental trade via AfCFTA, aligning with nationalist self-sufficiency but highlighting short-term pains for developing nations.

NGOs: From Aid Providers to Perceived Underminers

Trump’s policies have curtailed NGO operations, viewing them as extensions of foreign influence that undermine national sovereignty. Executive actions, including EO 14169 (January 20, 2025), dismantled USAID and halted aid shipments, freezing programs in Sudan and DRC. A global health memorandum explicitly stops funding NGOs “undermining the national interest,” impacting PEPFAR and leading to criticisms of endangering lives (e.g., potential 14 million additional deaths by 2030). Some analyses see this as an opportunity for Africa to pivot to direct investments, reducing dependency. New health agreements with nine African countries (December 2025) reflect a shift to bilateral, state-aligned priorities over NGO-led initiatives.

State Actors: Critiques and Interventions

The administration has targeted African governments perceived as failing on human rights or security. South Africa faced sanctions via EO 14204 (February 7, 2025) for land expropriation, labeled “egregious actions” amid claims of white farmer persecution. Nigeria was designated a “Country of Particular Concern” for religious freedom (October 31, 2025), with threats of humanitarian intervention over alleged Christian killings. Disruptive diplomacy brokered DRC-Rwanda peace (December 4, 2025) and advanced Sudan talks, but feuds (e.g., with Somalia over immigration) underscore a view of certain state actors as unreliable. This approach fuels authoritarian narratives discrediting civil society as “foreign agents.”

Monroe Doctrine: A Hemispheric Model with Limited African Extension

The “Trump Corollary” to the Monroe Doctrine, outlined in the December 4, 2025 NSS, revives 1823 principles to exclude foreign powers (e.g., China) from the Western Hemisphere, emphasizing sovereignty and non-intervention by outsiders. While not directly applied to Africa—where the NSS gives short shrift—the doctrine’s spirit informs a transactional policy prioritizing U.S. primacy over multilateralism. Extending it universally could promote national spheres of influence, but in practice, it risks interventionism (e.g., threats in Latin America), contrasting with Africa’s push for multipolarity.

Beneficial Nationalism: Alignment and Tensions

Influenced by Christian nationalism, Trump’s Africa strategy favors trade over aid, with $2.5 billion deals (June 2025) and $553 million Lobito Corridor investment (December 17, 2025). This resonates with beneficial nationalism by encouraging African economic autonomy, but immigration restrictions (EO 14161) and visa curbs threaten ties, potentially undermining security. Africa asserts itself globally despite these policies, with growth in high-performers like Senegal.

Outlook for 2026

The nationalist outlook could drive mutual benefits through fair trade and sovereignty, but risks escalation in conflicts and aid gaps. Africa’s resilience—via forums and self-reliance—may mitigate impacts, though balanced multilateralism remains key for stability.

Africa Kicks Off 2026: Nationalism Rising, Conflicts Grinding On, AFCON Heating Up

January 2, 2026—Africa enters the new year with momentum: AFCON knockouts looming, economic forecasts strong despite global headwinds, and nations asserting sovereignty amid US policy shifts. Trump’s “America First” tariffs and aid cuts force self-reliance, while ongoing wars test resilience. From a nationalist lens, these pressures accelerate beneficial independence—tariffs protect mutual fairness, reduced NGO interference curbs foreign meddling, and strong leaders prioritize national interests.

AFCON 2025: Knockouts Set for Fireworks

The tournament in Morocco reaches Round of 16 (Jan 3-6):

- Morocco vs Tanzania

- South Africa vs Cameroon

- Egypt vs Benin

- Nigeria vs Mozambique

- Algeria vs DR Congo

- Côte d’Ivoire vs Burkina Faso

- Senegal vs Sudan (strong favorites with Mané/Jackson)

- Tunisia vs Mali

Favorites like Morocco (hosts), Nigeria (Osimhen/Lookman firepower), Egypt (Salah chasing title), and holders Côte d’Ivoire advance strongly. No major upsets yet; expect intense clashes with stars shining.

Political Front: Elections Loom, Sovereignty Asserted

Uganda polls Jan 15: Museveni seeks 7th term amid crackdowns on dissent/activists.

Ethiopia, Somalia high-stakes votes later—likely predetermined, risking youth protests.

Recent: Guinea junta leader Doumbouya won landslide (Dec 2025) after barring opponents.

Tit-for-tat visa bans: Mali/Burkina Faso restrict US citizens after Trump’s expanded travel curbs (26 of 39 affected nations African). Aligns with pushing back external influence.

Security: Wars Persist, Famine Looms

Sudan: Civil war grinds on; famine confirmed/persisting in Darfur/Kordofan into Jan 2026. 30M+ need aid; spillover risks with South Sudan.

DRC: M23/foreign entanglements escalate; powder keg for regional war.

Sahel: Jihadist spread; Russia mercenaries falter, potential retrench.

US strikes (Somalia, Nigeria) frame as protecting interests/Christians—transactional security over blanket aid.

Economy: Growth Projected, Tariffs Force Pivot

IMF: Africa leads with most 6%+ growers (South Sudan/Guinea double-digit via resources). East Africa (Uganda/Rwanda/Ethiopia ~7%).

Trump tariffs (15-30% on many, ending AGOA perks) hit apparel/auto exports hard (Lesotho/Madagascar/South Africa job risks). Energy/minerals often exempt. Pushback: Diversify to AfCFTA/intra-Africa trade, BRICS/EU ties. Nationalism wins—less dependency, fairer reciprocity.

NGOs: Aid cuts/restrictions expose overreach; nations handle priorities directly.

2026 Outlook

Sovereign assertiveness grows—tariffs/NGO curbs as catalysts for self-reliant nationalism benefiting all stable players. Conflicts drag, but resource booms and continental trade offer paths forward.